Online sales tax

Online sales tax

Online sales tax is a sales tax that you may owe on items that you purchased over the internet or through a mail-in catalogue. Most states require their residents to pay sales tax on online purchases.

Only a few states listed below do not collect sales tax on internet sales or purchases. This tax is also called the online sales tax or the internet sales tax.

Who must pay online sales tax

When you purchase something online (on the internet), some sellers collect state sales tax on the online purchase. If the seller does not collect online sales tax, you have a good chance you must calculate the internet sales tax at the time of your tax return and pay the tax at that time. In that case, you must keep records of your purchases and pay the internet sales taxes directly to the state.

In general, you must pay internet sales tax if

- the items you bought are taxable in your state of residence,

- you used or consumed the items in your state of residence, and

-

when you purchased the items you either

- did not pay any online sales tax to the seller, or

- paid online sales tax at less than your state of residence sales tax rate

For example, let's say, you live in Illinois. You purchased a computer over the internet for use in the Illinois state and paid no sales tax on the purchase. The seller has not collected any state sales tax on internet sales (check your receipt, it would show there). In this case you would owe 6,25% internet online sales tax to the Illinois state.

For example, let's say, you live in Illinois. You purchased a computer over the internet for use in the Illinois state and paid no sales tax on the purchase. The seller has not collected any state sales tax on internet sales (check your receipt, it would show there). In this case you would owe 6,25% internet online sales tax to the Illinois state.

The obligation to pay internet sales taxes is determined by the location of the buyer, not the seller, and by the physical presence of the seller in the state where the item will be used or consumed.

Why are some internet purchases tax-free?

If the internet seller has a physical presence in your state, for example a store, office, or a warehouse, then the seller must collect online sales tax from customers in your state. On the other hand, if the internet seller does not have a physical presence in your state, then the seller is not required to collect internet sales taxes for internet sales into your state. This explains why some internet sellers collect the online sales tax from you and some do not.

Another option is that you may be living in a state which does not collect sales tax on internet sales. If you live for example in Alaska, Montana, New Hampshire, or Oregon, you may be exempt from the online sales tax on internet sales as these states do not collect any sales tax on internet sales.

Another option is that you may be living in a state which does not collect sales tax on internet sales. If you live for example in Alaska, Montana, New Hampshire, or Oregon, you may be exempt from the online sales tax on internet sales as these states do not collect any sales tax on internet sales.

Where do I report online sales tax on my tax return?

The online sales tax is reported on the state tax return. It is not reported on the federal tax return. Check the lines close to the end of the tax return. For example, Illinois state tax return, line 22; Wisconsin state tax return, line 36.

Do I report internet sales tax on my federal tax return?

No, the internet or online sales tax is governed by the state law and contributes to the state budget.

How much is the online sales tax on internet sales

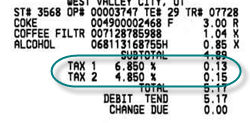

Sales tax on internet sales is equal to the sales tax you pay at the street store. When you look at the sales receipt from a street store, you can find the state sales tax rate on it. You can also find a list of states with their corresponding tax rates below.

| Alabama | 4,00% | Kentucky | 6,00% | North Dakota | 5,00% |

| Alaska | - | Louisiana | 4,00% | Ohio | 5,50% |

| Arizona | 5,60% | Maine | 5,00% | Oklahoma | 4,50% |

| Arkansas | 6,00% | Maryland | 6,00% | Oregon | - |

| California | 8,25% | Massachusetts | 6,25% | Pennsylvania | 6,00% |

| Colorado | 2,90% | Michigan | 6,00% | Rhode Island | 7,00% |

| Connecticut | 6,00% | Minnesota | 6,87% | South Carolina | 6,00% |

| Delaware | - | Mississippi | 7,00% | South Dakota | 4,00% |

| District of Columbia | 6,00% | Missouri | 4,22% | Tennessee | 7,00% |

| Florida | 6,00% | Montana | - | Texas | 6,25% |

| Georgia | 4,00% | Nebraska | 5,50% | Utah | 4,70% |

| Hawaii | 4,00% | Nevada | 6,85% | Vermont | 6,00% |

| Idaho | 6,00% | New Hampshire | - | Virginia | 5,00% |

| Illinois | 6,25% | New Jersey | 7,00% | Washington | 6,50% |

| Indiana | 7,00% | New Mexico | 5,00% | West Virginia | 6,00% |

| Iowa | 6,00% | New York | 4,00% | Wisconsin | 5,00% |

| Kansas | 5,30% | North Carolina | 5,75% | Wyoming | 4,00% |

Note: This list is informational only. Some states have many exceptions to certain goods. For example food and medications may be taxed differently. Some special rules apply in Texas and Delaware. Please, check your state law or consult with your tax professional.

Online sales tax deduction

The internet or online sales tax can be deducted on federal Schedule A, line 5.

I still do not understand if I have to pay the online sales tax

In case you are still confused about whether to pay or not to pay online sales tax on internet sales or purchases, you can just remember that if you live in a state that collects the sales tax and you purchase items on the internet that would normally be taxable in your state, you have to pay the online sales tax.

Online sales tax and use tax difference

When you as the buyer pay the tax, then the correct term for the tax is a "use" tax rather than a "sales" tax. The "sales" tax would be collected by the seller. But the term "sales" tax and "use" tax are being used interchangeably by the general public.

Sales tax on internet purchases from foreign country (Europe)

Online sales tax must be paid on taxable purchases from a retailer located in another country as well. For "taxable purchases", see the Who must pay sales tax on internet purchases section.

When you purchase something online from Europe, you need to be careful not to get taxed twice. Most countries in Europe do not use the concept of "sales" tax, but they use the concept of so-called VAT (Value Added Tax). The VAT is a different concept than the sales tax but in international trade behaves similarly to the sales tax. When you purchase something online in Europe and export the item to the USA, you will have to pay the sales tax in the USA on the purchase, but you can also apply at the European state customs (see their office at the airport) to have the VAT refunded to you. This applies to your online purchases in Europe, items that you export out of the European trade area. If you consume the item while being in Europe, you can not get the VAT returned to you.

When you purchase something online from Europe, you need to be careful not to get taxed twice. Most countries in Europe do not use the concept of "sales" tax, but they use the concept of so-called VAT (Value Added Tax). The VAT is a different concept than the sales tax but in international trade behaves similarly to the sales tax. When you purchase something online in Europe and export the item to the USA, you will have to pay the sales tax in the USA on the purchase, but you can also apply at the European state customs (see their office at the airport) to have the VAT refunded to you. This applies to your online purchases in Europe, items that you export out of the European trade area. If you consume the item while being in Europe, you can not get the VAT returned to you.

Other articles related to the internet sales tax

More information related to the online sales tax or internet sales tax can be found here:

Federal tax return

Federal tax calculator

Alternative minimum tax

You are welcome to discuss your questions about sales tax online in the Maxi-Pedia discussion forum, see below.

It is easy, just include the code provided below into your HTML code.

Delicious

Delicious Digg

Digg StumbleUpon

StumbleUpon Furl

Furl Facebook

Facebook Google

Google Yahoo

Yahoo