How to report and tax Google AdSense income

How to report and tax Google AdSense income

Reporting AdSense Google income on a tax return in easy and can be accomplished in a few quick and simple steps. This page provides information on how to approach determining tax on your AdSense Google income and how to report it on the federal tax return.

Reporting AdSense Google income involves filling out several tax forms.

Must I report Google AdSense income and pay tax on it?

In general all your income must be reported to the IRS and state Departments of Revenue and is subject to taxation. Whether you end up paying taxes on your AdSense income (or AdSense revenue, see here AdSense revenue) depends on several factors which will be discussed later. State taxes apply as well.

How to report AdSense Google income (Google tax)

How you report Google AdSense income depends on whether you earn it as "other income" in addition to your full-time job or if you earn AdSense Google income as your, so called, "self-employment income."

In case you earn Google AdSense income while at the same time having a full time job, and your AdSense income is less than $400/year, you will find out that your AdSense income increases your tax liability when you report your Google AdSense income on your tax return. You will find out that either you are not going to get back as high of a refund as you did last year, or you may have to pay, because you have not paid Google tax on your AdSense income during the year. In this case you might want to look into itemizing your deductions (1040 Schedule A).

If earning Google AdSense income is your self employment (your full time job, or you just make more than $400/year), your Google tax reporting gets a little more complicated. You report your AdSense income on form 1040 (U.S. Individual Income Tax Return), and in addition to this basic form, you also need to be aware of

If earning Google AdSense income is your self employment (your full time job, or you just make more than $400/year), your Google tax reporting gets a little more complicated. You report your AdSense income on form 1040 (U.S. Individual Income Tax Return), and in addition to this basic form, you also need to be aware of Schedule C (Profit or Loss From Business) and Schedule SE (Self-Employment Tax). In this case, you do not itemize deductions, but you write off expenses (save your receipts). You might be subject to alternative minimum tax, and you will most likely need to pay estimated taxes. The following paragraphs explain more of this scenario.

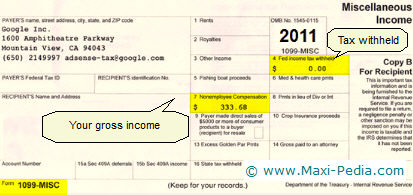

Will I get 1099-MISC tax form on my AdSense Google income?

You can take a look at your AdSense Google account and see in the Payments History section how much you have made over the past year. If you make money with AdSense and you make more AdSense Google income than $400 per year, Google is required to mail you so called 1099-MISC form.

The 1099-MISC form summarizes your Google AdSense earnings generated by your account in the Google tax period.

The 1099-MISC form summarizes your Google AdSense earnings generated by your account in the Google tax period.

Will I get W-2 on my AdSense Google income?

No. Form W-2, also called Wage and Tax Statement, is used in an employer-employee relationship. AdSense income which you receive from Google is a business income (payment for services). It is not a wage; therefore, Google does not mail out W-2 forms to AdSense publishers.

Do I need to pay taxes on AdSense if I do not receive 1099-MISC?

In general, all income is subject to taxation and reporting to the IRS. In case you have not received the 1099-MISC form, and you have made over $400 AdSense Google income in the Google tax period, it is possible that the form got lost in the mail, but you still need to report your income on your tax return because Google files a copy of the 1099 form with IRS. In other words, IRS receives your AdSense Google tax information even if you have not received your 1099-MISC AdSense Google tax form. Some websites will not send you a 1099-MISC because you did not make over $400.00, but it is still your responsibility to report it.

Also note that the $400/year limit applies to income from all your sources. The limit does not count your Google AdSense income separately, but it is applied to AdSense income together with your other online earnings that you may have. The limit comprises all the income you are getting from all different sources on the internet.

If you did not receive your 1099-MISC from Google, it is easy to check your Google AdSense income on the Payments History tab in your AdSense Google account.

How to tax Google AdSense income

The tax burden applied to our AdSense income depends greatly on your marital status and on your level of your net income. Federal tax rates are progressive which means that the more AdSense Google income you make, the more taxes you have to pay on it, i.e. your average tax rate increases (see federal tax calculator). In other words, someone who makes $1,000 Google AdSense income pays less percentage than someone who makes $50,000 AdSense income.

Your Google AdSense taxation burden is determined also by your marital status. If you are single, the portion of your deduction attributable to the AdSense portion of your adjusted gross income (line 37 of your tax return) is most likely less than if you were filing your return as a head of household. Deduction decreases the adjusted gross income and results in a lower taxable income.

Your Google AdSense taxation burden is determined also by your marital status. If you are single, the portion of your deduction attributable to the AdSense portion of your adjusted gross income (line 37 of your tax return) is most likely less than if you were filing your return as a head of household. Deduction decreases the adjusted gross income and results in a lower taxable income.

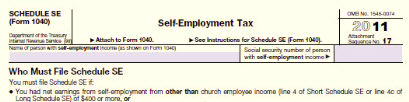

AdSense income self-employment tax

It is also important to mention that if your AdSense Google income is $400/year or more, you need to file Schedule SE (self-employment). The self-employment tax rate is a flat rate of 15.3% (applied to income after expenses, but, note, before deductions; 12.4% for social security and 2.9% for Medicare).

The self-employment tax is payable on the total earnings. So, if your earnings are $401, you would pay 15.3% of the entire $401, which means you would owe around $61.

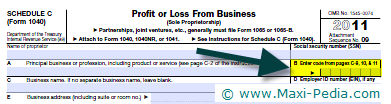

Which schedules to use to report AdSense Google income?

Google AdSense earnings are reported on Schedule C (Profit or Loss From Business). You report your AdSense Google income on line 1 and then follow the instructions on that form. Part II provides space for recording your expenses. Depending on your business model, you can take advantage of deducting various expenses. Sample expenses:

- hosting fee,

- domain registration fee,

- software costs,

- computer costs,

- contract work,

- meeting expenses,

- advertisement (AdWords costs; see AdSense AdWords difference),

- computer repair,

- educational books,

- internet connectivity costs (Cable/DSL bill),

- electronic equipment costs (printer, scanner, camera),

- office supplies,

- phone bill,

- mileage for business.

Computer expenses need special consideration. In some cases, your computer can be expensed, but in most cases, it needs to be depreciated and deducted. See computer expense as a section 179 tax deduction. You will need to file Form 4562 Depreciation and Amortization.

If you sell products on your website, you can also deduct the cost of goods sold. When attaching schedules to your tax return, do not forget to attach them in the appropriate order (see tax return checklist for more information).

Can I deduct my own time from AdSense income?

If you hire a contractor who performs your website development/coding/work, you can deduct your contracting expenses on the line 11 (Contract labor) of Schedule C. Unfortunately, your own work on your own website is not considered a tax expense.

What code to use on Schedule C?

When you report Google AdSense income on Schedule C (Profit or Loss from Business), you are required to provide a special code on line B. AdSense Google income is often reported with either of the following two codes:

When you report Google AdSense income on Schedule C (Profit or Loss from Business), you are required to provide a special code on line B. AdSense Google income is often reported with either of the following two codes:

- 711510 Independent Writers

- 519100 Other information services (Internet publishing & broadcasting)

See a table at the end of Schedule C Instructions for more details on AdSense Google income report codes.

Google AdSense income tax withholding

Tax withholding is deducted from your paycheck when you work for an employee. Your relationship with Google is a business; therefore, in most cases Google does not make tax withholding on your Google AdSense income. The burden of making advance payments to the IRS is on your back. You have to estimate how much money you will make with Google (see Make money with Google AdSense) and pay estimated taxes.

However, there is an exception to this rule. When you registered with Google, you filled out a W-9 form which included a box that said "Exempt from backup withholding". If you checked this box, you have chosen not to have any taxes withheld during the year. If you left the box unchecked, Google should be withholding 28% from your each check (this is also the case if you did not provide your Social Security Number). You can change your Google tax information anytime (log into your AdSense account, then go to My Account, Tax Information).

Google AdSense income estimated taxes

If AdSense Google income generates you more than a few hundreds per year, you might need to pay estimated taxes. In general, if you expect to owe at least $1,000 in tax for your tax period, you need to take a look at the Estimated Tax Worksheet (see Form 1040-ES Estimated Tax for Individuals). It is because if you owe more than $1,000 in tax, you are subject to interest and tax underpayment penalty. The Estimated Tax worksheet will guide you through making an estimate of your tax liability, and it will tell you if you need to pay estimated taxes on your AdSense income.

AdSense income tax

You can find more information related to Google AdSense income tax and Google AdSense income reporting in Publication 334 Tax Guide for Small Business. Never rely on any private website to calculate your final Google tax. For your own safety, please, always refer to IRS published instructions and check with your accountant or tax advisor.

It is easy, just include the code provided below into your HTML code.

Delicious

Delicious Digg

Digg StumbleUpon

StumbleUpon Furl

Furl Facebook

Facebook Google

Google Yahoo

Yahoo